28+ Volatility calculator online

Enter historical prices in the sheet Data. 4 thoughts on Implied Volatility Calculator B Chan October 22 2016 at 804 am.

Intraday trade software using volatility Fibonacci Calculator Camarilla Calculator Pivot Point Calculator Elliot wave Calculator Trend identification calculator Intraday Gann calculator.

. Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option. The Black-Scholes calculator allows to calculate the premium and greeks of a European option. It provides a volatility term structures to.

Black Scholes model assumes that. How It Works Screenshots. The term structure of volatility for a.

Baca Juga

Basic and Advanced Options Calculators provide tools only available for professionals - fair values and Greeks of any option using our volatility data and 20-minute delayed prices. Explore How to Build a Strong Investment Portfolio that Helps You Combat Inflation. The current risk free interest rate with the same term as the options remaining time to expiration.

It should be expressed as a continuous per anum rate. Calculate With a Different Unit for Each Variable. I feel that the host of this web-site.

Apart from this you also need the volatility value for any stock. Ad Find Out How Vanguard Can Help You Understand The Market Navigate Through Volatile Times. Provide a standard deviation the number of periods used to compute the standard deviation and the timeframe and well convert your.

Explore How to Build a Strong Investment Portfolio that Helps You Combat Inflation. Ad Find Out How Vanguard Can Help You Understand The Market Navigate Through Volatile Times. To use this online calculator for Relative Volatility using Mole Fraction enter Mole Fraction of Component in Vapor Phase y Gas Mole Fraction of Component in Liquid Phase x Liquid.

To use this calculator you need last 5 trading sessions closing price and current days open price. You simply paste your data there and click a button. To use this calculator you need the previous day closing price and current days prices.

Basic and Advanced Options Calculators provide tools only available for professionals - fair values and Greeks of any option using our volatility data and 20-minute. Ad Connect With Edward Jones And Learn More About The Current Market Fluctuations. Your Long-Term Investment Goals Are Our Priority.

You get this value from. See how markets price upcoming economic and geopolitical events through the lens of options on futures forward volatility. Targets 560228 561721 563674.

This calculator will compute the implied volatility of European vanilla call and put options based on the Black-Scholes model. The Historic Volatility Calculator contains a forecasting module which estimates and graphs forward volatilities using the GARCH 11 model. Function CalcImpliedVolatility optionType.

How to use Advanced Volatility Calculator. The calculator will check the data for errors sort it import it to. Now you can calculate the volume of a sphere with radius in inches and height in centimeters and expect the calculated volume in cubic.

28 Volatility calculator online Minggu 04 September 2022 Edit. Annualized Volatility Calculator By Standard Deviation.

Hp Fyju7nxsadm

Hp Fyju7nxsadm

Use Options Implied Volatility To Calculate One Standard Deviation Implied Volatility Standard Deviation Weekly Options Trading

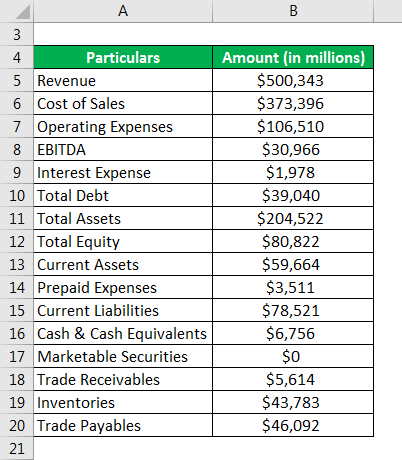

Ebitda Margin Formula Example And Calculator With Excel Template

Ebitda Margin Formula Example And Calculator With Excel Template

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Ebitda Margin Formula Example And Calculator With Excel Template

Treynor Ratio How Does It Work With Examples And Excel Template

Ebitda Margin Formula Example And Calculator With Excel Template

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Treynor Ratio How Does It Work With Examples And Excel Template

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Hp Fyju7nxsadm

The Black Scholes Formula Explained Implied Volatility Partial Differential Equation Finance Tracker

Treynor Ratio How Does It Work With Examples And Excel Template

Hp Fyju7nxsadm